Culture Is the Strategy Behind Sustainable Growth

Andrew Rosen shares how advisory firms can scale through partnership, autonomy, and human-centered leadership—without private equity or outside control.

Andrew Rosen speaks to advisors, firm leaders, and executives navigating growth, consolidation, and cultural change. His perspective is shaped by decades of building—not selling—an advisory firm grounded in partnership, autonomy, and long-term value.

Rather than focusing on markets or products, Andrew challenges audiences to rethink ownership, leadership, and experience in an industry increasingly shaped by private equity and rapid technological change.

Culture as a Competitive Advantage

Meet Andrew Rosen, Diversified’s Visionary

In an industry focused on scale, valuation, and exits, Andrew Rosen argues that culture—not capital—is the real operating system of a firm.

Through partnership models, human-centered use of AI, and intentional integration, Andrew shows how advisory firms can grow without sacrificing autonomy, identity, or trust. His work reframes growth away from short-term valuation and toward ownership, experience, and long-term value creation.

About Diversified

As a proud G2 lead firm, Diversified LLC delivers comprehensive financial services tailored to every stage of our clients’ lives. From financial planning and investment management to tax and insurance strategies, we simplify wealth management by bringing everything together seamlessly. Our team is dedicated to building lasting relationships while ensuring our advisors have the tools and resources they need to prioritize what matters most—our clients.

Named a Best Place to Work via multiple regional outlets and a top workplace for financial planning firms nationwide, we are equally committed to our team’s satisfaction and success.

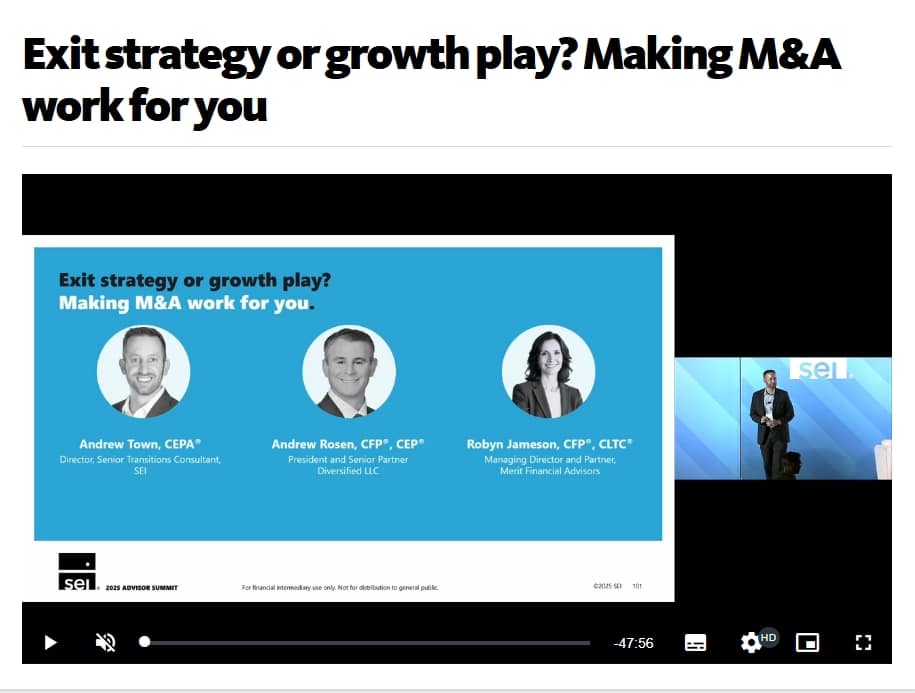

View Andrew’s Panel at the SEI Advisor Summit here

Speaking topics

All of Andrew’s keynotes, fireside chats, and interviews are grounded in one core belief: culture is the strategy behind sustainable growth.

Partnership Over Payout → Building true meritocracy in advisory firms

Scaling Without Private Equity → Growth with autonomy and control

Human-Centered, AI-Powered → Using technology without losing trust

The Experience Economy → Why client experience is the real moat

Value Over Valuation → Building firms for longevity, not just exit

Integrate, Don’t Aggregate → Why cohesion beats accumulation

- Financial advisors and firm leaders

- RIA executives and partners

- Conference and summit audiences

- Podcast listeners focused on leadership, growth, and the future of advice

- Organizations navigating recruiting, succession, or consolidation

Andrew is best suited for:

- Fireside chats

- Moderated interviews

- Keynote conversations

- Long-form podcasts and Q&A formats

His style is thoughtful, conversational, and candid; designed to spark reflection rather than deliver prescriptions.

- Contributor to Forbes and Kiplinger

- Regular industry commentator and podcast guest

- Speaker at advisor and leadership conferences

- Author of an upcoming book on culture, planning, and long-term decision-making

Invite Andrew to Speak:

Featured Thought Leadership In:

Andrew’s insights on culture, planning, and leadership have been featured in national publications including Forbes and Kiplinger.

Kiplinger

Forbes

Diversified

Interested in a keynote, fireside chat, or interview?

Andrew Rosen brings a thoughtful, candid perspective on culture, growth, and leadership—designed to spark conversation, not deliver prescriptions.